Bitcoin, Ethereum Bulls Brace to Defend Last Line of Support

Bitcoin remains under the pressure of a persistent tightening monetary policy amid macroeconomic uncertainty. The current environment has seen a diminishing appetite for risk, driven by the belief that the transition to a more accommodating monetary policy will be delayed, especially in light of the Federal Reserve’s “higher for longer” stance. Rising costs and stubborn inflation further contribute to this apprehension.

Regarding cryptocurrencies, the expected upward movement is contingent on the introduction of a spot ETF. In the medium term, the upcoming halving event, which will reduce the supply of Bitcoin, is viewed as another catalyst for a positive trend. Moreover, the Fed’s high likelihood of transitioning to a neutral interest rate period in 2024, even without a decline in interest rates, plays a role in stabilizing the current trading range.

Throughout the year, a support level has formed near $25,700. This suggested an optimistic outlook for Bitcoin as the intensity of crypto investors’ reactions to recent economic data remained subdued, hinting that the current economic climate is already priced in, and a new bull cycle could begin. But, that was until new geopolitical risks emerged

.

This week, headwinds for cryptos have surged with the onset of conflict in the Middle East. Simultaneously, recent developments have negatively impacted the cryptocurrency market. In comparison to other risky markets, the geopolitical situation in cryptocurrency has yet to be fully factored in. In the days ahead, if investors view Bitcoin as a safe-haven asset, as has been the case in the past, it may potentially rejuvenate the ongoing pessimistic outlook for the crypto sector.

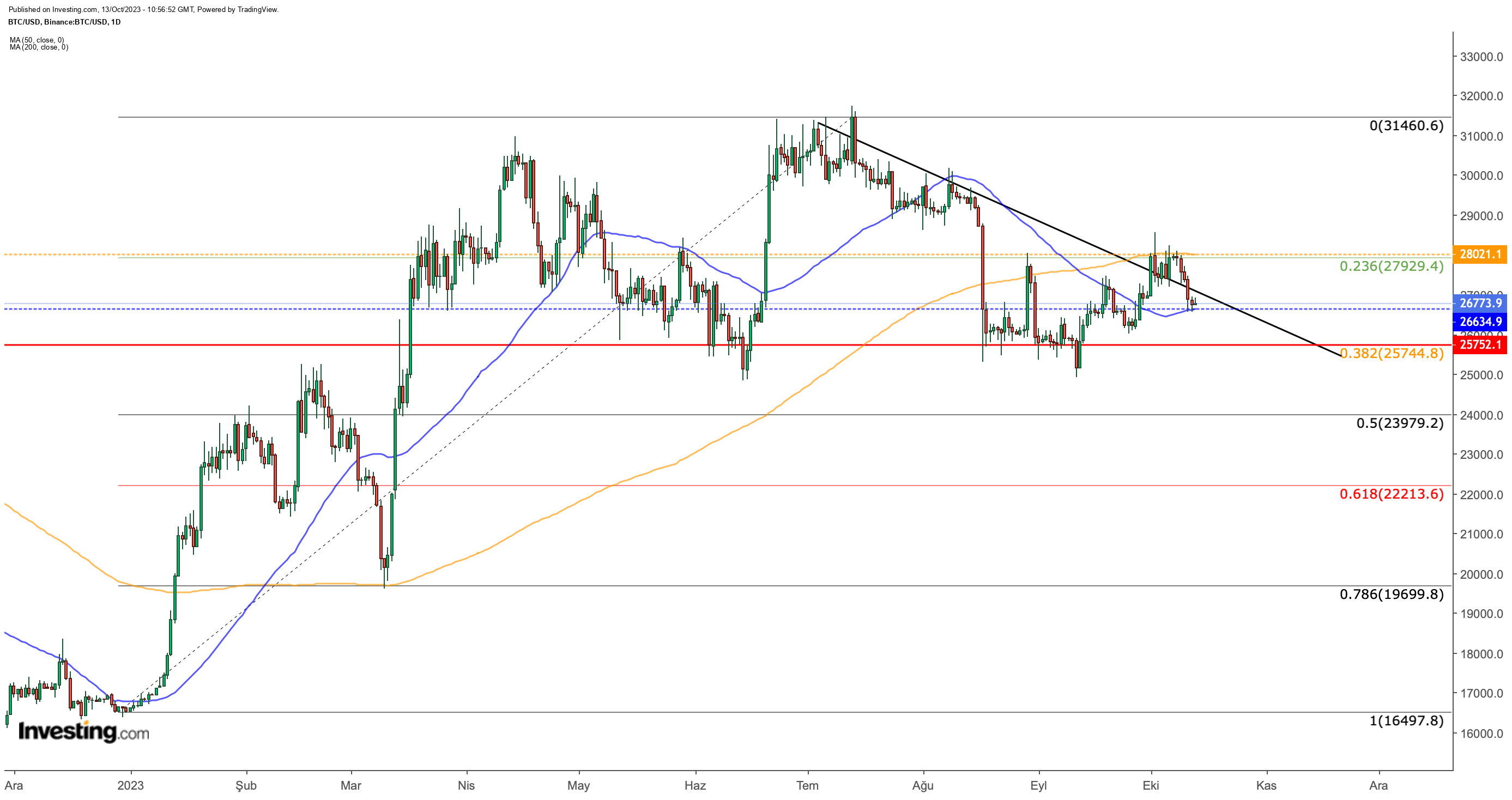

Bitcoin: Nosedive Awaits If $25,700 Is BreachedFrom a technical standpoint, the cryptocurrency’s response to the 200-day moving average has been noteworthy. Despite reaching the $28,000 level early in October, BTC encountered formidable resistance at this 200-day moving average. The inability to garner enough buyer volume to surpass this average contributed to a downturn, further exacerbated by heightened tensions in the Middle East.

As the week unfolded, the price began testing the 50-day moving average, retreating to around $26,600. Additionally, the moving average crossover, known as the “dead cross,” signaled a bearish trend in September. While the initial response to this situation was buying, Bitcoin’s inability to breach the 200-day moving average has reinforced the bearish outlook..

Based on the current circumstances, the $26,600 level is emerging as a pivotal support for Bitcoin. If BTC’s price once more drops below the 50-day moving average (MA), we could witness a buying reaction around $25,700, regarded as another crucial support line.

Consequently, the upcoming trajectory is anticipated to revolve around re-establishing a position above the 50-day MA. However, if the anticipated upward breakout does not materialize, there’s a possibility of another descent toward the $22,000 region, potentially at a swifter pace.

When taking a broader perspective on Bitcoin, observing its weekly performance reveals that the $28,600 range has maintained significance as a pivotal point since April. Referring to the lower range observed at the conclusion of 2022, stemming from.

Bitcoin’s peak price in November 2021, the technically significant resistance point for a potential ascent based on Fibonacci levels rests at $28,600. Over the last six months, Bitcoin’s price has remained within this region, exhibiting a horizontal trajectory.

While the $25,600 level acts as the last line of defense against a decline below this range, $28,600 is deemed a pivotal resistance to remain above the 200-day moving average (MA) in the bullish zone.