Adopting Bitcoin Strategy have made Microstrategy’s Stock Soars 206%

Microstrategy’s stock (Nasdaq: MSTR) has risen 206% after the company adopted bitcoin as its primary treasury reserve asset. The business intelligence firm now holds 152,800 bitcoins, acquired for a total cost of $4.53 billion, and it has plans to buy even more.

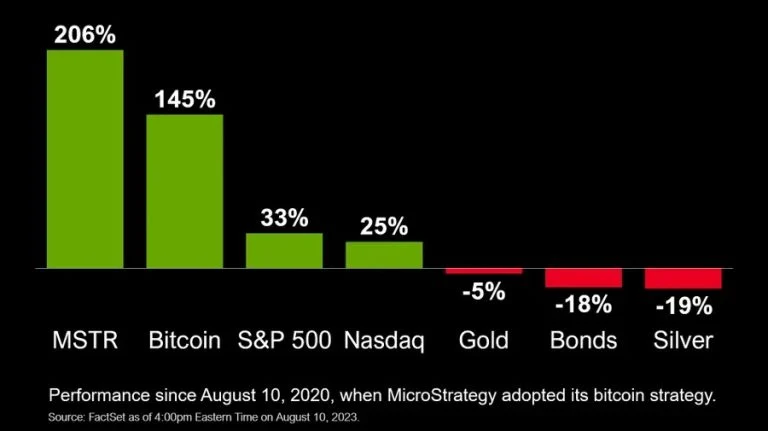

Microstrategy’s Stock Outperforms Bitcoin, S&P500, Nasdaq, Gold, Silver

The stock of business intelligence firm Microstrategy (Nasdaq: MSTR) has risen 206% since the company adopted its bitcoin strategy, Executive Chairman Michael Saylor stated on Twitter Friday. He tweeted:

Three years ago today Microstrategy announced that it had adopted bitcoin as its Primary Treasury Reserve Asset, purchasing 21,454 BTC for $250 million, or ~$11,653 per bitcoin.

Microstrategy adopted its bitcoin strategy on Aug. 10, 2020. In comparison, during the same time period, bitcoin has experienced a 145% increase, while the S&P 500 has risen 33% and the Nasdaq 25%, according to a chart Saylor shared on Twitter. Meanwhile, gold has seen a decline of 5%, and silver has decreased 19%.

Michael Saylor

Blackrock, the world’s largest asset manager, is a major shareholder of Microstrategy. In February, Blackrock disclosed that it owns 760,000 shares of Microstrategy Incorporated, which represents 8.1% of the company. The asset manager is also trying to launch a bitcoin exchange-traded fund (ETF).

Earlier this month, Microstrategy disclosed that it now holds 152,800 bitcoins, acquired for a total cost of $4.53 billion, or $29,672 per BTC. The company is also planning to buy more BTC with stock sales of up to $750 million.

Saylor explained in August 2020 that his company’s bitcoin strategy “seeks to maximize long-term value” for shareholders. He described the world’s largest cryptocurrency as “a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.” The executive added: “Since its inception over a decade ago, bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.”