Bitcoin ETFs Collectively Hold Nearly 1% of Bitcoin’s Total Supply as of February 2024

In less than a month of trading, the nine newly established spot Bitcoin exchange-traded funds (ETFs) collectively hold over 200,000 BTC in assets under management. This figure excludes Grayscale’s converted GBTC fund.

In less than a month of trading, the nine newly established spot Bitcoin exchange-traded funds (ETFs) collectively hold over 200,000 BTC in assets under management. This figure excludes Grayscale’s converted GBTC fund.

According to K33 Research, the nine newly launched ETFs had accumulated a total of 203,811 bitcoins, equivalent to $9.5 billion as of February 8 2024. These ETFs, launched on January 11 2024, include offerings from:

- BlackRock (IBIT)

- Fidelity (FBTC)

- Bitwise (BITB)

- Ark 21Shares (ARKB)

- Invesco (BTCO)

- VanEck (HODL)

- Valkyrie (BRRR)

- Franklin Templeton (EZBC)

- WisdomTree (BTCW)

The newly established ETFs now collectively hold nearly 1% of Bitcoin’s total supply of 21 million BTC. This amount surpasses the holdings of:

- Software company, MicroStrategy, which owns 190,000 BTC

- Stablecoin issuer Tether’s 66,465 BTC by over three times

- The combined holdings of all public Bitcoin miners

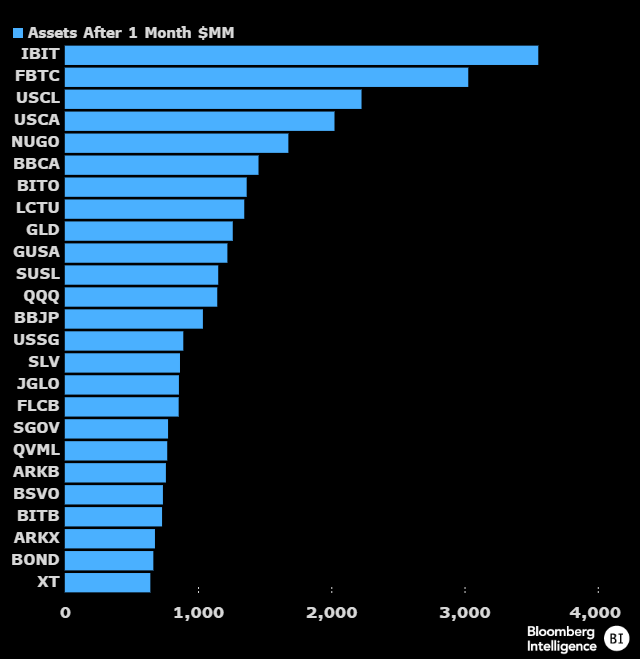

As per data from BitMEX Research, BlackRock’s IBIT spot Bitcoin ETF is leading the pack with over 80,000 BTC ($3.7 billion) in assets under management. Following closely is Fidelity’s FBTC, with more than 68,000 BTC ($3.2 billion) in assets.

According to Bloomberg ETF analyst, Eric Balchunas, the holdings of IBIT and FBTC also lead among the top 25 newly established ETFs overall after one month of trading.

In contrast, assets held by Grayscale’s converted GBTC fund have declined by almost 25%, dropping from approximately 619,000 BTC ($28.8 billion) to 469,000 BTC ($21.8 billion) since January 11 2024.

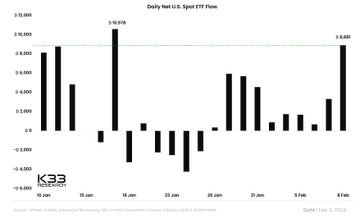

According to K33 Research analyst, Vetle Lunde, February 8 2024 marked the strongest daily net inflow into all Bitcoin investment vehicles globally since January 2021. Lunde mentioned, ‘4.52% of the circulating BTC supply is currently held by investment vehicles,’ with a total of 887,443 BTC in assets under management.

Bitcoin is presently trading above $48,075, nearing the $48,494 figure that was achieved on January 11 2024, the day the ETFs were approved.