Examining the CFA Franc: Its Functions, Participating African Nations, and Controversies.

Due to its structure, the countries involved in it, and the debates it has sparked, the CFA Franc, a currency used in 14 African countries, has attracted a lot of interest recently.

What does CFA Franc mean?

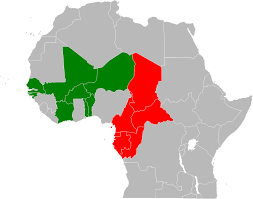

Two sets of African nations share the CFA Franc as their common currency:

West Africa

Central Africa

Its origins can be found in the colonial period, when these countries were ruled by Europeans, primarily France. The acronym “CFA” stands for “Financial Cooperation in Africa” or “Financial Cooperation in Africa.” There are two versions of this currency:

1.) CFA Franc BCEAO (XOF)

It is regulated by the Banque Centrale des États de l’Afrique de l’Ouest (BCEAO), or the Central Bank of West African States. The XOF is used by countries in West Africa, including:

Benin

Burkina Faso

Ivory Coast

Guinea-Bissau

Mali

Niger

Senegal

Togo

2.) CFA Franc BEAC (XAF)

The currency is managed by the Banque des États de l’Afrique Centrale (BEAC), or the Bank of Central African States. XAF is employed by countries in Central Africa, such as:

Cameroon

Central African Republic

Chad

Republic of Congo

Equatorial Guinea

Gabon

Mechanism and Operation

There is a fixed exchange rate mechanism in place for the CFA Franc. This indicates that its value is linked to a different coin, first the French Franc and then the Euro. The exchange rate (peg) between the two CFA Francs and the euro is fixed at exactly €1 = F.CFA 655.957. By stabilising the market and lowering currency swings, this technique aims to improve trade and investment predictability.

The Disputations

Limited Monetary Autonomy: One of the major points of contention is that these African nations’ monetary autonomy is constrained by the fixed exchange rate regime. They are unable to alter their exchange rates in order to deal with particular economic issues like excessive inflation or sluggish economic growth. Contrary to what some claim, the CFA “helps stabilise the national currencies of Franc Zone member-countries and greatly facilitates the flow of exports and imports between France and the member-countries,” according to these critics.

Deposits with the French Treasury: These nations’ obligation to deposit 50% of their foreign exchange reserves with the French Treasury is another key issue of disagreement. The question of whether this norm limits these nations’ ability to completely manage their monetary policy and raises questions regarding financial sovereignty.

Neo-colonialism and Historical Legacies:

According to detractors, the CFA Franc’s past associations with colonialism have helped to maintain a neo-colonial relationship between these African nations and France. Questions concerning their economic independence and sense of national identity are raised by the name and design of the currency, which conjures up a feeling of dependence on previous colonial powers.

A new currency named “The Eco” will be introduced in a number of West African nations in 2019. It would no longer be necessary to deposit reserves in France and would remain tied to the Euro. This action, which tries to address some of the issues, is still up for discussion and negotiation.

The members of UEMOA are included in the Economic Community of West African States (ECOWAS), which is a larger organisation that has plans to implement its own single currency for its members by 2027.