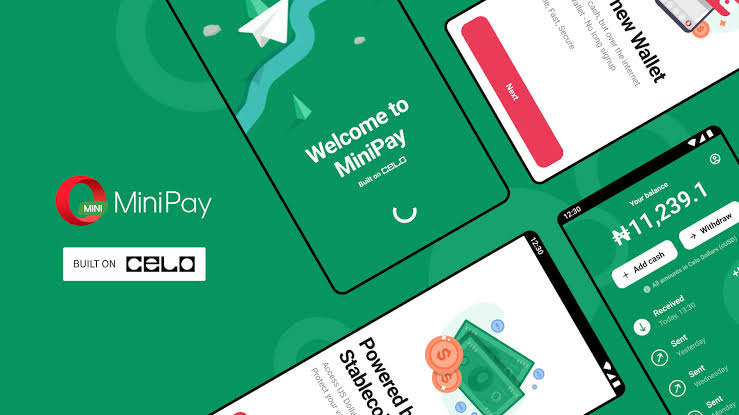

On the Celo Blockchain, Opera has released the MiniPay Stablecoin Wallet for users in Africa.

A blockchain-based wallet called MiniPay has been launched by Opera, the company that created the well-known browser Opera Mini.

Opera claims that MiniPay, which is directly integrated into the Opera Mini browser, will make it simpler and less expensive for people in Africa to buy stablecoins and send or receive them by utilising mobile phone numbers.

MiniPay, which enables quick wallet-to-wallet stablecoin transfers with fees under a cent utilising mobile phone numbers and quick onboarding with automated wallet backup through Google, is a partnership between Opera and the Celo Foundation.

According to Opera, key management complications, such as forgetting the secret recovery phrase and passwords, are the most frequent cause of consumers losing their digital assets. MiniPay helps users to retrieve their wallet in the event that their phone is lost by automatically backing up their keys to their personal Google Drive. Users may also simply reload the programme.

Leading industry partners are integrating with Opera to support regional payment options like cards, bank transfers, airtime, and MPESA. Because MiniPay is a non-custodial wallet, users can add and withdraw stablecoins into their local currency by using local partners rather than any traditional banking infrastructure.

The FiatConnect standard from Celo, which has an expanding list of integrated partners and will enhance the Cash-In-Cash-Out experience globally, will also be supported by MiniPay.

“We are excited to introduce MiniPay, a ground-breaking collaboration between Opera and the Celo Foundation that responds to ongoing concerns about how payments are handled in the area. Users in Nigeria, Kenya, Ghana, and South Africa have expressed ongoing complaints about exorbitant costs, erratic service uptimes, a lack of clarity on the status of transactions, and restricted access to mobile data, according to Jrgen Arnesen, Opera’s EVP Mobile.

The capacity to transfer, receive, and ultimately earn money without obtaining authorization makes this relationship a turning point in the realm of digital banking.