REPORT | Because to Clear Regulations, Seychelles accounted for the majority of venture capital funding given to African blockchain startups in 2023.

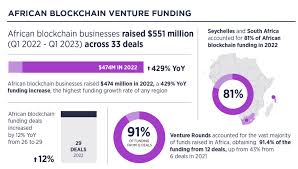

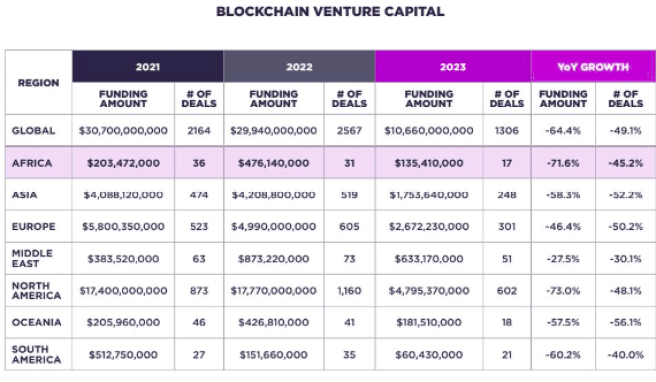

In 2023, venture capital funding for blockchain firms in Africa was $135.4 million, a 72% decrease from the previous year [2022]. Ultimately, just 6.1% of the $2.2 billion raised that year [2023] went to businesses on the continent in the blockchain space; this is a further fall from 15.1% of the total in 2022. In 2023, 1.3% of venture capital funds that found businesses were on the continent.

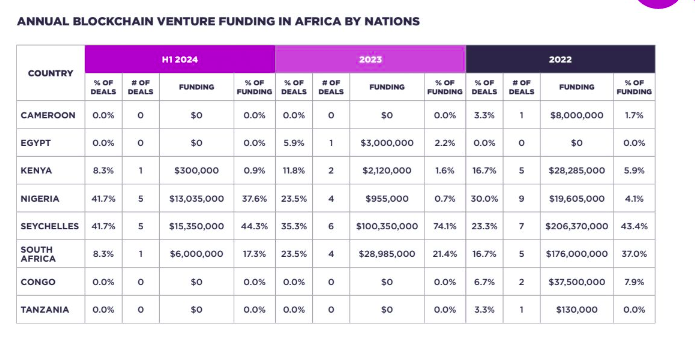

After more investigation, it was discovered that blockchain businesses in South Africa and the Seychelles had raised 95% of the total funds. Surprisingly, Seychelles led the investment for six years running, raising more than half of the total amount of money.

Remarkably, a comparable 2022 CV VC Africa analysis found that 81% of all blockchain and cryptocurrency startup funding in Africa in 2022 went to South Africa and the Seychelles.

In contrast to South African firms, which received $29 million from four agreements, Seychelles blockchain startups raised $100 million from six deals, according to the 2023 report published by CV VC Africa. The following Seychelles startups raised capital in 2023:

- Beldex, which raised $3 million

- Crypto exchange Bitget, which raised $10 million, and

- Scroll, which raised $50 million

Within South Africa:

- Momint raised $1.25 million, while

- Carry1st secured $27 million

Below is a list of all the startups that raised capital in 2023 for the remainder of the continent, along with information about their country and deal size:

- Beldex (Seychelles): $3 million

- Scroll (Seychelles): $50 millon

- AlphaBloq (Kenya): $120,000

- Bitget (Seychelles): $10 million

- BoundlessPay (Nigeria): $300,000

- IvoryPay (Nigeria): $135,000

- Kotani Pay (Kenya): $2 million

- Seso Global (Nigeria): $720,000

- Zap Africa (Nigeria): $300,000

- Zone (Nigeria): $8.5 million

- House Africa (Nigeria): $400,000

- Jamit (Nigeria): $235,000

- Momint (South Africa): $1.25 million

- Shamba Records (Kenya): $300,000

- Azuro (Seychelles): $3.5 million

- Canza Finance (Nigeria): $2.3 million

- Elfi (Seychelles): $5 million

- Nftti (South Africa): $6 million

- Quantamm (Seychelles): $1.85 million

- Renq Finance (Seychelles): $2.35 million

- Seedify (Seychelles): $10 million

- Carry1st (South Africa): $27 million

- Cellula (Seychelles): $2 million

- Gamic (Nigeria): $1.8 million

- Giza (Egypt): $3 million

- Halo (Seychelles): $3 million

- Web3 Sanctuary (South Africa): $135,000

According to the CV VC research, despite the continent-wide loosening of legislation pertaining to cryptocurrencies, 12 nations continue to forbid the industry, and 36 more have “uncertain” regulatory frameworks. Due to their well-defined legal frameworks, South Africa and the Seychelles have become the continent’s top locations for blockchain and cryptocurrency investment.

“Regulatory assurance is important for investment in [blockchain startups], and South Africa and Seychelles are two of the six markets where crypto is legal in Africa,” said Brenton Naicker, Principal and Head of Growth at CV VC.