REPORT | Meme Coins Rule the Chart and Story, Driving Down the Total Crypto Market Cap by Over 14% in Q2 2024

According to a recent CoinGecko analysis, the entire market capitalization of cryptocurrency regained some of its gains in Q2 2024 after almost reaching all-time highs in Q1 2024. It decreased by $408.8 billion (-14.4%) and closed at $2.43 trillion in June 2024.

The eagerly awaited fourth halving of Bitcoin occurred in Q2 of 2024 and went off without a hitch. According to the Q2 2024 Crypto Industry Report, “Each halving ushers in what crypto natives consider a new era, though the market response to the event was largely muted.” “After the euphoria in Q1 [2024] following the U.S. spot Bitcoin ETFs’ approval, Q2 proved to be fairly turbulent for Bitcoin and the cryptocurrency market overall.”

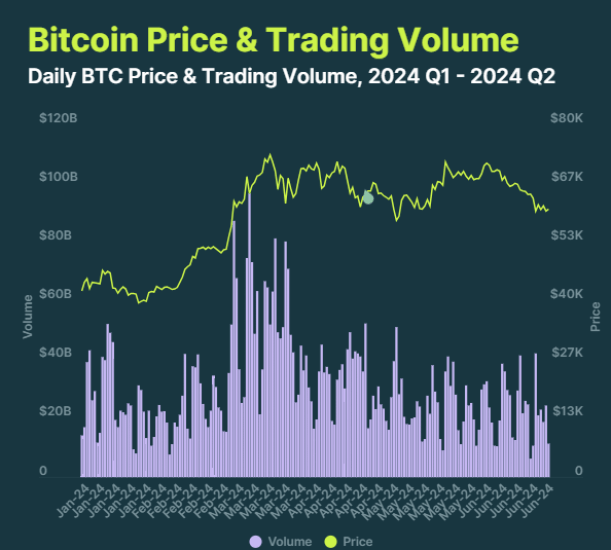

The market leader Bitcoin saw a -11.9% decrease at the end of the quarter after reaching an all-time high of $73,098 in mid-March 2024. According to CoinGecko’s estimate, the cryptocurrency will fluctuate between $58,000 and $72,000 levels, and the fourth halving had no impact on its price.

In Q2 2024, the daily average of bitcoin trading volume dropped to $26.6 billion, a -21.6% decrease from the previous quarter.

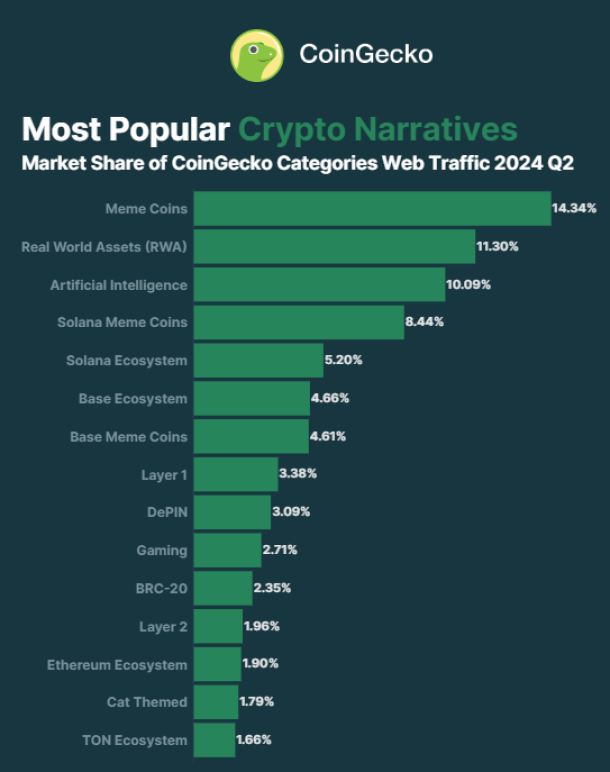

Among the major patterns that persisted in the first quarter of 2024 were:

- Meme Coins

- Real World Assets (RWA), and

- Artificial Intelligence (AI)

With 35.7% of the market share, these tales were the most often accepted in Q2 2024.

“Meme coins dominated the table, appearing in four of the top fifteen most popular tales about cryptocurrencies. In the meantime, Solana, Ethereum, Base, and TON—four out of fifty-nine blockchain ecosystems—made it into the top fifteen cryptocurrency tales. The two most well-liked ecosystems, Solana and Base, each received 22.9% of market attention.

CoinGecko also noticed an intriguing trend: in Q2 2024, 107,725 ETH were burned, whilst 228,543 ETH were emitted. This indicates that $ETH got inflationary.

Only seven days in the second quarter had more ETH burning than emissions. By contrast, Q1 figures for this period were 66 days.

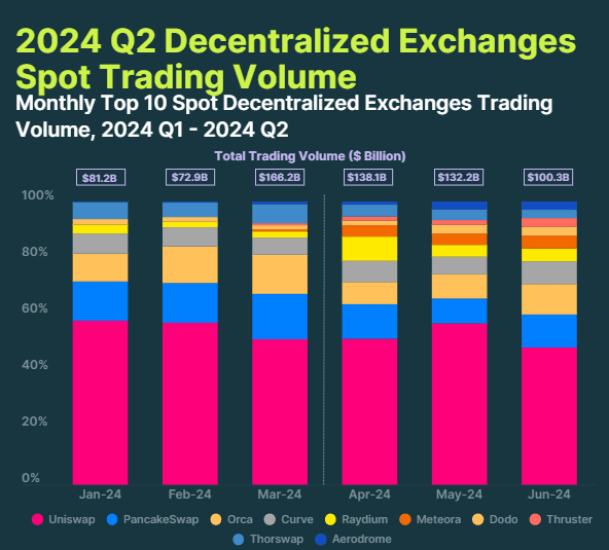

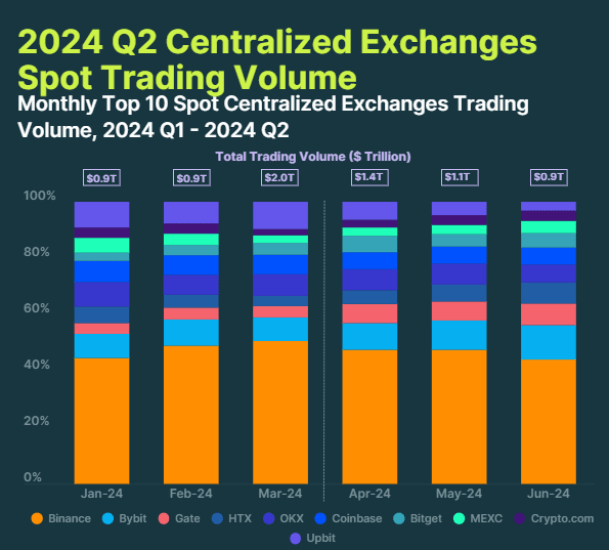

Lastly, the quarter saw a decrease in activity on centralised exchanges and a rise in trade on decentralised exchanges. The spot trading volume on the top 10 centralised exchanges (CEXs) was $3.40 trillion. This corresponds to a quarterly (QoQ) decline of -12.2%, which is consistent with the performance of the entire cryptocurrency market.

Spot trading volume on the top 10 decentralised exchanges (DEXs) was $370.7 billion. This indicates a +15.7% quarterly (QoQ) rise, with DEXes benefiting from a spike in meme coins and numerous airdrops in Q2 2024.