BITCOIN | Since the collapse of FTX, Bitcoin Has Seen One of the Largest Realised Losses

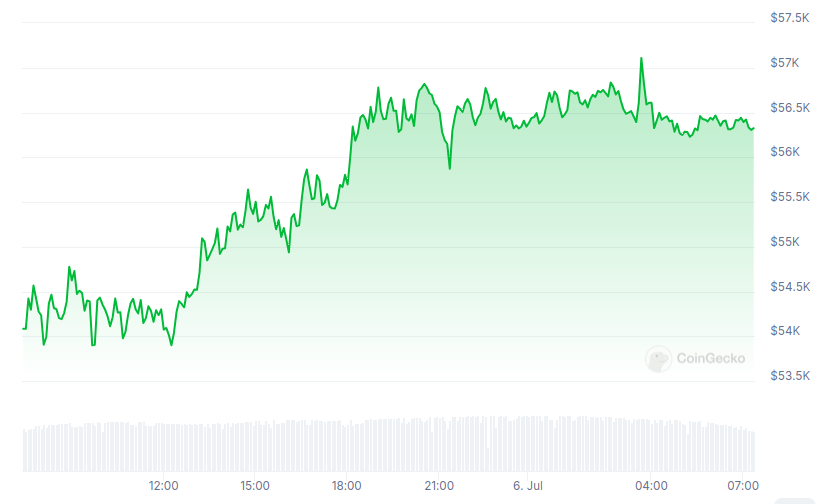

After plunging to its lowest point in more than four months, the price of Bitcoin has now rebounded. According to CoinGecko, the cryptocurrency is up 4.1% in the previous day, peaking at little over $56,400.

According to crypto analysts, Bitcoin had dropped to $53,717.34, its lowest since late February 2024, the day before, resulting in one of the biggest realised losses since the collapse of FTX, precisely the fifth biggest realised loss ever.

“On July 5 [2024], Bitcoin’s total realised loss shot up to $814 million in less than an hour’s time. Those who held Bitcoin for one to three months, known as short-term holders, suffered losses totaling $587 million. The way this group responded to market volatility shows how short-term holdings are more vulnerable than long-term holders. – Van Straten, James

However, Staraten observes that long-term investors showed tenacity and only slightly increased the selling pressure.

“This stability from seasoned investors indicates confidence in Bitcoin’s long-term prospects, contrasting sharply with the short-term market fluctuations driven by newer entrants reacting to immediate news events.”

The German Federal Criminal Police Office also shifted roughly $75 million in Bitcoin it held to cryptocurrency exchanges, and announcements that the trustee for Mt. Gox was moving more billions worth of the cryptocurrency and had later started making payments to certain creditors were also blamed for the decline.

However, Julio Moreno, Head of Research for CryptoQuant, does not see the latter reasons as bearing much significance in the market at the moment.

He said via Telegram that “prices have fallen mostly due to selling/profit taking from large investors (whale) and mid-size miners.”

“Selling from Mt. Gox and other entities (German Government) is relatively small compared to the overall pool of money in Bitcoin.”