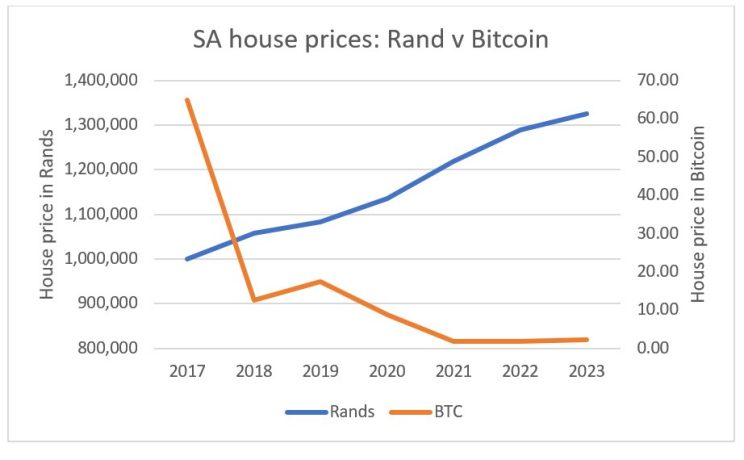

Measured in bitcoin, SA house prices have fallen off a cliff

Prices have dropped to less than a 20th of the cost of six years ago.

It’s a fun exercise to do every year or so: measuring the cost of South African housing in rands versus bitcoin (BTC).

The graph below tells the story. We assume a starting price in rands of R1 million in 2017 and inflate by the average increase in house prices annually. House prices are up just under a third in rand terms over the last six years, so our R1 million house purchased in 2017 is now worth R1.33 million.

The same house would have cost roughly 65 BTC in 2017 and is now worth just 2.4 BTC.

Depending on how you look at it, this is a bad investment if you’re paying in BTC. In other words, you overpaid in BTC if buying in 2017. In rand terms, you’re just about keeping pace with inflation.

The results are skewed by the huge bitcoin bull market between 2017 and 2018 when prices went up nearly seven-fold. This was followed by a bear market extending into 2019 when SA housing became substantially more expensive in BTC terms.

Though the above graph shows that house prices in bitcoin have risen over the last two years, this comes after extraordinary bull market runs in 2017 and again in 2021.

The current BTC price of about $29 000 is less than half its November 2021 peak of around $65 000.

“

Over the years, BTC has had its ups and downs in its quest to be recognised as a credible asset class,” says Carel de Jager, head of distributed ledger technology at the Council for Scientific and Industrial Research (CSIR).

“At first, many brushed it off as a short-lived trend. Later, it was mainly linked with illicit activities. By 2020, it was labelled as an environmental disaster.

“However, recently, there’s a shift in perspective with major commercial banks and ETFs [exchange-traded funds] gearing up to gain exposure.

“Regardless of these changing views, it’s hard to deny that Bitcoin has been the standout investment of the past decade, easily outshining assets like real estate. The graph clearly demonstrates how property prices have depreciated when compared to Bitcoin since 2017.”