MILESTONE | ETH ETFs Post Over $1 Billion Trading Volume ‘Surpassing Expectations’ on First Day of Trading

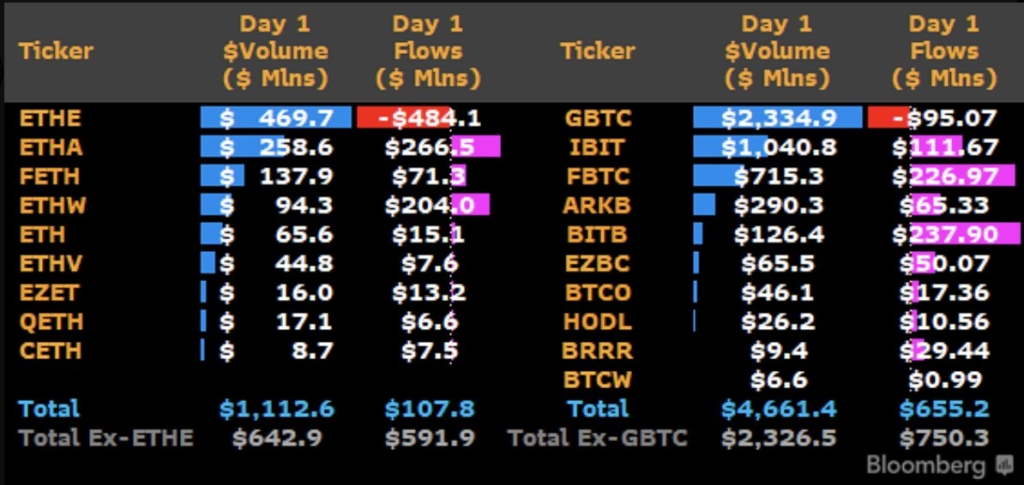

On their first day of trading, the nine Ether Exchange-Traded Funds (ETFs) in the United States had a collective trading volume of around $1.08 billion, which is 23% of what the spot Bitcoin ETFs witnessed. The ETFs, which went public on July 23, 2024, saw net inflows of $106.6 million on their first day of trading, while the sole fund that saw outflows was Grayscale’s recently converted Ethereum Trust, which saw net withdrawals of $484.1 million.

- BlackRock’s iShares Ethereum Trust ETF (ETHA) led with $266.5 million of inflows, followed closely by

- The Bitwise Ethereum ETF (ETHW) with $204 million in net inflows

- The Fidelity Ethereum Fund ETF (FETH) came in third with $71.3 million

- Grayscale’s Ethereum Mini Trust, a spinoff product launched by the asset manager with lower fees, generated $15.2 million in new inflows

- Franklin Templeton’s Franklin Ethereum ETF (EZET) netted $13.2 million, while

- 21Shares’ Core Ethereum ETF (CETH) saw $7.4 million in inflows

James Seyffart of Bloomberg Intelligence stated that the ETF launch “pretty much” lived up to his expectations.

Seyffart declared, “[If] we compare it to a standard ETF launch, it was a smashing success.”

According to Juan Luan, senior investment strategist at Bitwise Invest, demand for ETH exceeded forecasts right away.

When the outflows from the conversions of ETHE ($484M) into GBTC ($95M) are taken out, the total ETH flows ($108M) represent 79% of the BTC flows ($655M). Because GBTC was still at a discount and ETHE was already trading at NAV upon conversion, he argued, the outflows were probably greater.

However, spot ETH trading activity on centralised exchanges hardly altered, according to cryptocurrency market data source Kaiko, even though spot Ethereum ETFs attracted more than $1 billion in trade volume on their debut day. On July 24, 2024, the price of $ETH even fell further. According to CoinGecko, the value of the second-largest cryptocurrency is $3,161 at the time of publication, down 8% over the previous day and 7.4% over the previous seven.

In contrast, the U.S. stock market saw a notable decline that represented its worst one-day performance since late 2022. The Nasdaq Composite experienced a larger fall of 3.64%, while the S&P 500 suffered a decline of 2.3%. The main causes of this sell-off were the underwhelming quarterly earnings reports from big tech firms like Alphabet and Tesla.