Money TXs have not been forced out of blockspace by Bitcoin Ordinals: Glassnode

Money TXs have not been forced out of blockspace by Bitcoin Ordinals: Glassnode

Despite worries that Bitcoin Ordinals are clogging the network, there is little proof that inscriptions are displacing higher-value Bitcoin BTC from blockspace.

counts down

$26,216

Financial transfers.

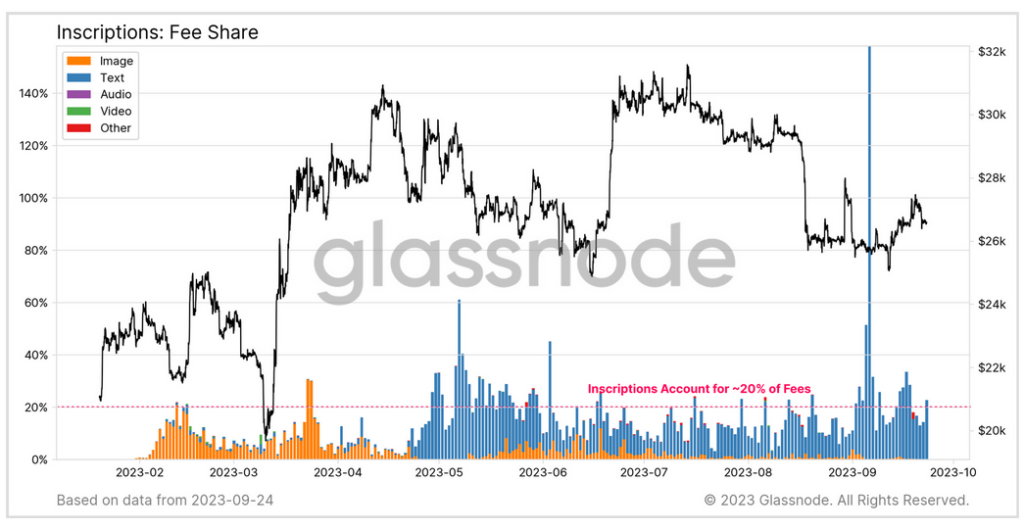

In its “The Week On-chain” report published on September 25, on-chain analytics company Glassnode stated that there is “minimal evidence” that inscriptions are replacing monetary transfers.

According to the company, this is probably because inscription users typically specify modest cost rates and indicate a willingness to wait longer for confirmation.

“Inscriptions seem to be buying and consuming the cheapest available blockspace, and are easily replaced by more urgent monetary transfers,” the study said.

Since its launch in February 2023, Bitcoin Ordinals have contributed significantly to the network’s daily transaction volume.

Glassnode pointed out that this hasn’t always been represented in its share of mining fees, with inscriptions only accounting for 20% of Bitcoin transaction fees.

Miners may be experiencing financial hardship because to the intense rivalry among miners and the impending halving event, which will put a strain on their profitability unless BTC prices rise soon.

Bitcoin’s price is currently $26,216, although many industry experts anticipate some price growth in the months leading up to the halving event, which is expected to take place in April 2024.

The BRC-20 tokens, which were issued one month after Casey Rodarmor announced the Ordinals protocol on Bitcoin in February, are currently the source of the majority of inscriptions.

Rodarmor proposed “Runes” as a potential replacement for BRC-20s on September 25. He said that a fungible token protocol based on unspent transaction outputs wouldn’t produce as much “junk” unspent transaction outputs on the Bitcoin network.