Stablecoin Market Share is Shrinking While Most Cryptocurrencies Surge

(Bloomberg) — One of the more head-scratching phenomenas playing out in the digital-asset world is the shrinking of the stablecoin market while most cryptocurrencies are posting outsized gains this year.

Traders use stablecoins to move money into and out of cryptocurrency markets, swap funds between exchanges and as a haven in times of high volatility. Often the market capitalization of the tokens increases during rallies and declines during downturns. So far this year, the total value of the crypto market has jumped around 50% to about $1.2 trillion, while the stablecoin sector has shrunk almost 8% to around a two-year low of $127 billion, according to researcher CCData.

This discrepancy could have several explanations. Hoping for higher returns, investors may be rotating out stablecoins and into appreciating market leaders Bitcoin and Ether, according to Jacob Joseph, a research analyst at CCData. Stablecoins don’t pay interest and usually seek to maintain a one-to-one ratio with other assets such as the dollar, hence their name.

Crypto advocates downplay the decline, with some citing the overall light trading volume in the wake of last year’s market collapse.

“I think the answer is that we’re not in a proper bull market, or if we are it’s only the very early innings of it,” said Sidney Powell, chief executive officer of lending marketplace Maple Finance.

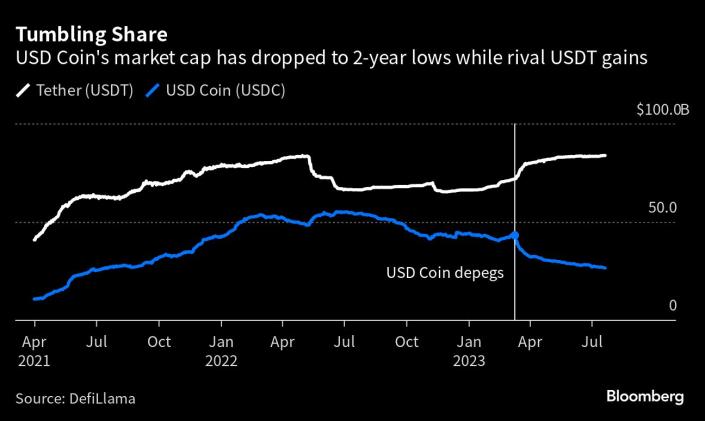

Moreover, several stablecoin issuers faced their own unique issues earlier this year, likely pushing some investors to rotate into other assets. Paxos is winding down the Binance-branded BUSD token as the largest exchange confronts increased regulatory pressure. USDC issuer Circle had a portion of its deposits stuck for a few days in a California bank that went bust; the deposits were returned.

As these stablecoins tottered, in July, Tether — the world’s biggest stablecoin — reached its all-time high market cap. Tether now accounts for 65.9% of the stablecoins sector, per CCData.

Lawmakers are also reviving efforts to regulate the US crypto industry, placing greater emphasis on consumer protection following a string of high-profile company failures last year.

Earlier this month, Senators Cynthia Lummis, a Republican from Wyoming, and Kirsten Gillibrand, a Democrat from New York, submitted a new version of their bill from last year that features more safeguards, including for stablecoins.

Higher interest rates may also come into play, with some investors less likely to park money in the tokens when more attractive fixed returns can be found elsewhere.

“The rise in interest rates means that people holding stablecoins are almost always giving up a chance to earn interest,” said Garett Jones, chief economist at Bluechip, which ranks stablecoins. “The end of the Fed’s zero interest rate policy makes it far more expensive to hold too much wealth in stablecoins.”