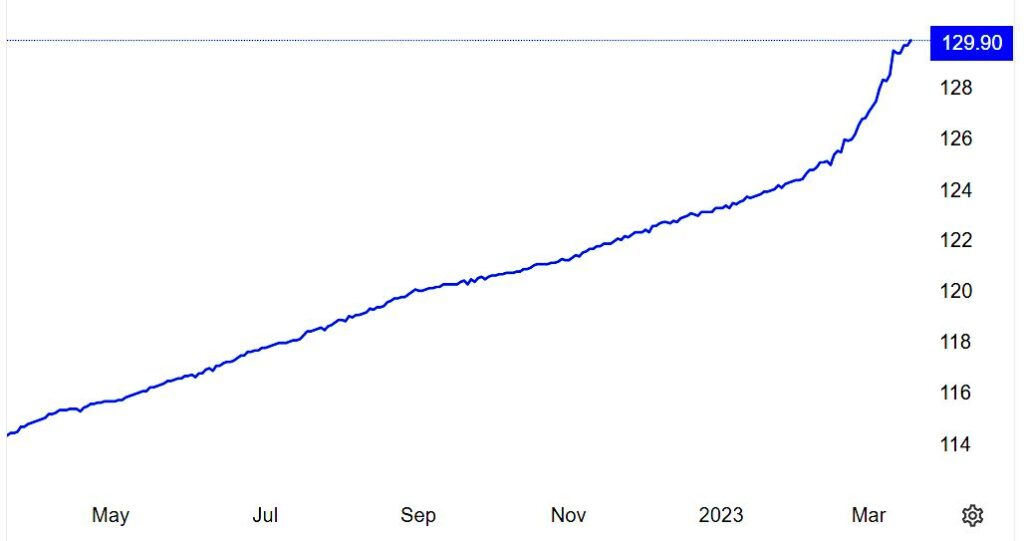

The Kenya Shilling Hits a New Low as Dollar Scarcity Bites – a 12% Drop in Value in 12 Months

As fears grow about the scarcity of the US currency and its potential effects on the economy of East Africa, the Kenya Shilling has dropped to a new low of 129 Kenya Shillings (KES) against the US dollar. In the past year, inflation in Kenya has risen, resulting in the devaluation of the Kenya Shilling by almost 12%, from KES 114.35 to almost KES 130 to the dollar, as shown in the accompanying chart.

The soaring cost of the US dollar is leading to further economic decline in Kenya, as it makes commodity prices abroad increasingly expensive for local importers and manufacturers.

Local sources indicate that importers are now purchasing a dollar for as much as 147 Kenyan Shillings, causing a surge in commodity prices. In February 2023, inflation rose to 9.2% from 9% in January 2023, and this was reportedly the third-highest rate since the previous year when Kenyans began to feel the impact of high commodity prices.

This increase puts the inflation rate above the Central Bank’s upper limit of 7.5%, placing it in the “red zone.”

Analysts point to the higher interest rates in the US as one reason driving up the Shilling.

“A strong recovery in the dollar index is likely to push the USDKES to 130 as demand for US treasuries continues to rise because of higher interest rates,” said Kenyan financial analyst, Rufus Kamau.

But a recent Bloomberg report says Kenya’s foreign reserves have been facing mounting pressure due to the impact of high oil prices, resulting in a decline to $6.57 billion as of March 9 2023, which is equivalent to 3.67 months of import cover.

Central Bank of Kenya however has put this figure slightly higher, in a weekly update.

“The usable foreign exchange reserves remained adequate at USD 6,560 million (3.66 months of import cover) as at March 16 2023. This meets the CBK’s statutory requirement to endeavor to maintain at least 4 months of import cover.”

Kenya relies primarily on tea exports, tourism receipts, diaspora remittances, and horticulture shipments, to generate the foreign currency necessary to pay for imports and service external debt.

On the domestic side, the East African nation is said to be experiencing dry weather conditions coupled with severe drought in certain parts of the country that have caused reduced yields on farm produce leading to an increase in prices.

Local analysts also point to external debt repayment obligations as contributing to the overall scarcity of foreign exchange.