Why is Ether (ETH) price up today?

Ethereum price is up today as a growing combination of network and technical factors push ETH price above the $2,800 level.

Ether ETH$2,840 is up today, rallying in excess of 3% over the last 24 hours to trade above the $2,800 level. Ether’s price is up 16% over the last seven days, mirroring Bitcoin’s BTC$52,215, 16.3% uptick over the same time period.

The rally in Ether can be attributed to Ether’s decreasing supply on exchanges due to staking, accumulation from ETH whales and growing optimism from retail and institutional investors.

Ethereum staking moves higher

According to data from Dune, the supply of ETH staked on the Beacon Chain has now reached 30,708,316 ETH, accounting for 25.56% of all ETH’s current supply. This is worth over $86.68 billion at the time of writing and 31.65% of these ETH are staked through Lido.

The chart below shows that investors deposited more than 600,000 ETH between Feb. 1 and Feb. 15 into the Ethereum 2.0 staking contract.

Ethereum restaking protocols are also seeing an increase in the number of tokens locked on layer-2 blockchains. The total value locked (TVL) on Ethereum restaking protocol EigenLayer increased by 33% over the last seven days to $7.09 billion on Feb. 15, surpassing cryptocurrency lending protocol JustLend and Aave to claim the third position, according to data from DefiLlama.

Restaking involves reusing staked or locked-up Ether to boost Ethereum staking yield and earn a percentage of protocol yield and points toward airdrops.

An increase in staked Ether ensures the efficiency and security of the network, and it also reduces the supply of tokens available to buy and sell on exchanges, resulting in increased demand as supply is reduced. This could be a bullish sign for Ether.

Ethereum pro traders increase their bullish bets

Ether’s price action has historically mirrored Bitcoin. This has added to traders’ expectations that with BTC breaking above $50,000 on Feb. 12, ETH could follow suit and make a similar break above $3,000 over the next few days.

Derivatives metrics show a significant increase in how speculative traders place their long bets.

Data from CryptoQuant shows the ETH funding rate spiked to 0.4% on Feb. 13 – the highest since Jan. 8, suggesting that pro traders are placing more leveraged bets on a potential ETH price ascent.

Increasing positive funding rates suggests that traders with long positions are willing to pay higher fees to short traders since they anticipate that an increase in price will occur.

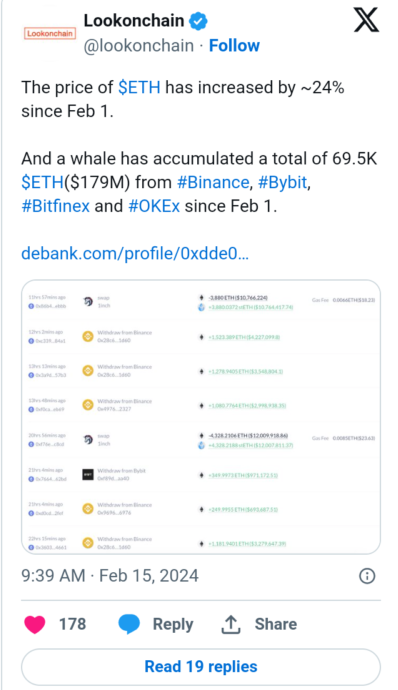

Ethereum whales are increasing their holdings

Ether’s price rally is further boosted by the optimism that a spot Ethereum exchange-traded fund (ETF) will be approved in the first half of 2024.

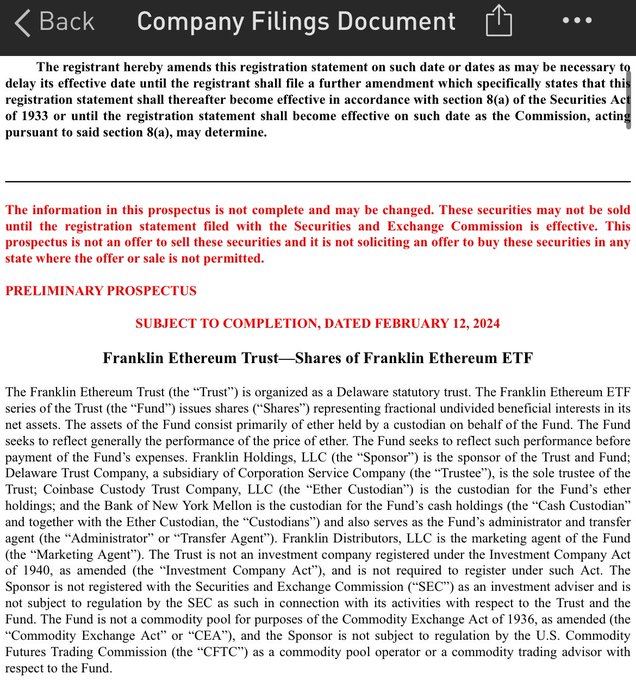

The most recent development is that asset management firm Franklin Templeton joined the Ether ETF race when it filed an S-1 application with the SEC on Feb. 12.

In readiness for this, institutional investors are displaying their optimism for the largest altcoin with increased purchases of ETH.

According to data from blockchain analytics platform Lookonchain, the 24% price increase in ETH since the beginning of February could be attributed to a whale who has purchased approximately 69,500 ETH, worth $179 million at current rates, from leading exchanges such as Binance, Bybit, Bitfinex, and OKX in the same period.