Bank of International Settlements Advises Central Banks, Including in Africa, to be Wary When Outsourcing CBDC Development

According to the report, to successfully implement a CBDC, central banks must consider the objectives and use case for a CBDC (ie its core factors), engage with a wide range of internal and external stakeholders, and include a number of considerations of different factors relating to a CBDC project.

Central Banks are being advised to prepare to adequately meet the ‘far-reaching implications’ in their operations as a result of the CBDC implementation process.

In a November 2023 report, the Bank for International Settlements (BIS) highlighted new information security and operational risks to central banks stemming from implementing Central Bank Digital Currencies. The report analyses the operating, technology, third-party, and business continuity risks for the issuing central bank.

According to the report, to successfully implement a CBDC, central banks must consider the objectives and use case for a CBDC (ie its core factors), engage with a wide range of internal and external stakeholders, and include a number of considerations of difference factors relating to a CBDC project. These considerations are visualised in the report.

Countries may have a range of objectives for issuing CBDCs, including:

• Increasing financial inclusion, or more generally, broadening access to the financial system to serve the unbanked and under-banked population.

• Extending public access to safe central bank money (as opposed to private digital currencies).

• Safely meeting future needs and demands for payment services, including ensuring competition, data privacy and the integrity of the payment system.

• Reducing costs and improving access to domestic and cross-border payments.

• Contingency planning in case cash use suddenly declines or a private digital currency is widely adopted.

• Countering tax evasion and criminal uses of currency.

• Avoiding currency substitution and preparing for potential competition from other CBDCs.

• Creating a payment foundation to better support innovation (eg smart contracts, internet of things etc).

• Facilitating the distribution of central bank money and government benefits, particularly in remote areas.

For CBDCs to be a reliable means of payments, central banks also need to address, among others, the risks of interruptions or disruptions and ensure integrity and confidentiality.

“A key risk are the potential gaps in central banks’ internal capabilities and skills. While many of the CBDC-related activities could in principle be outsourced, doing so requires adequate capacity to select and supervise vendors.”

The report said banks should perform careful and realistic assessments about this, including concerning their ability to develop the required skills internally, ahead of a potential decision to outsource functionalities to third parties.

“The evaluation should also assess the risks of outsourcing (eg technology lock-in or vendor risks). Supervision capabilities should also be in place to ensure appropriate due diligence for CBDC processes.”

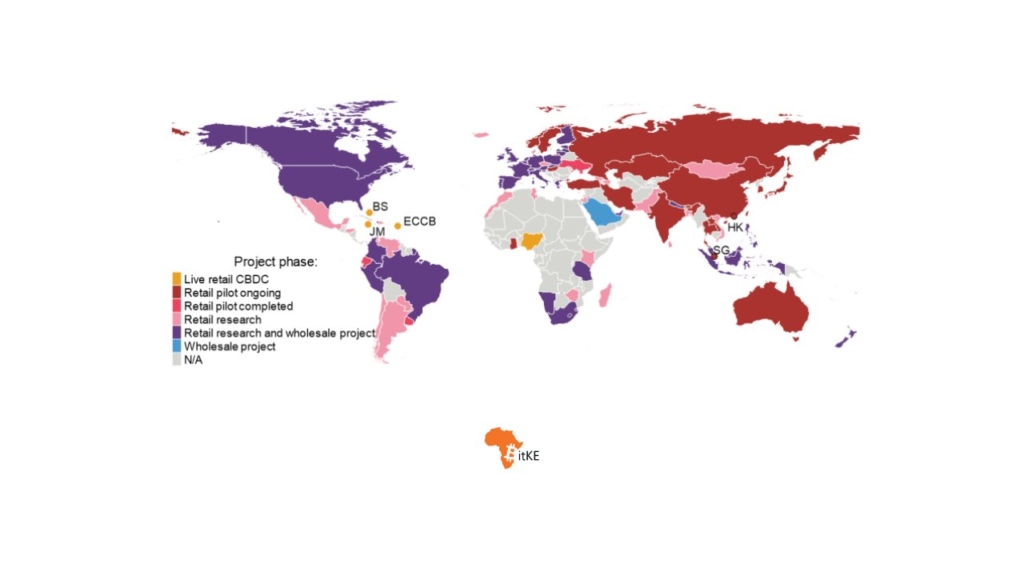

While the report was developed following interviews with Central Bankers in the Americas, the implications ring true for African Central Banks as well.

Here some of the leading CBDC projects that are being developed by third-party organizations:

- The Central Bank of Nigeria partnered with Bitt, the financial technology firm behind Dcash as the technology provider of Nigeria’s eNaira CBDC.

- At the same time, another major third party in CBDC activities across the continent is Giesecke + Devrient which is working with the Central Banks in Ghana and Eswatini.

According to the Bank for International Settlements report, the risks posed by a CBDC will be tied to design choices as well as external factors. Adopting a risk management approach throughout its lifecycle can help to reduce undesirable outcomes, including governance issues, and support a more robust decision-making process for a CBDC.

Issuing a CBDC will have major implications for the business model of central banks and the risks they face, and it will modify their risk profiles.

“Given the major implications of issuing a CBDC, this should not be considered to be a technological project but rather a fundamental change in the way that the central bank operates,” says the BIS report.