Binance’s Stablecoin BUSD Market Capitalization Slides 90% from Peak – Will it Affect Binance Exchange?

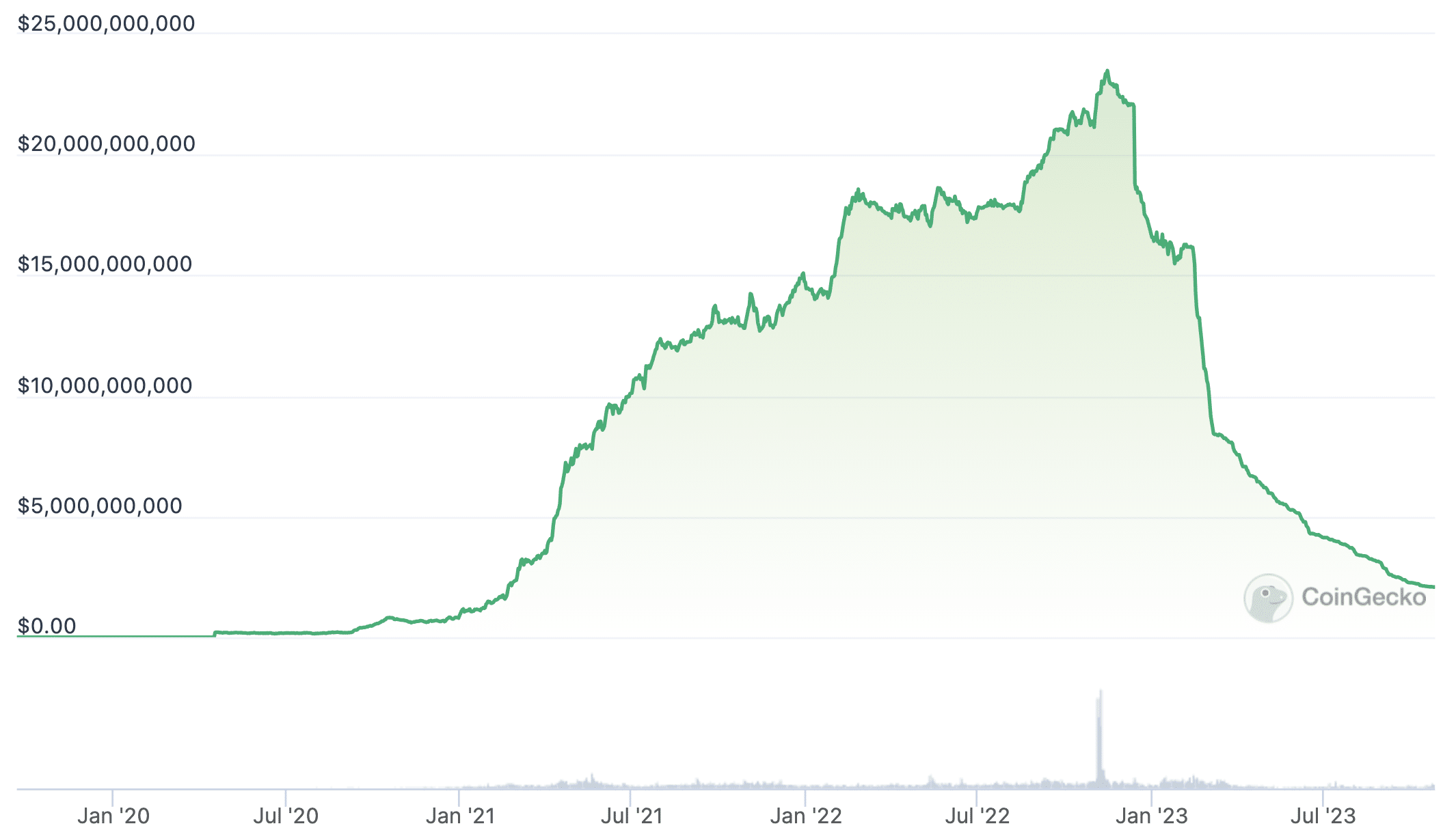

Binance USD (BUSD), the stablecoin issued by Paxos for crypto exchange Binance, has seen a decline in market capitalization of more than 90% from its peak last year.

According to CoinGecko data, BUSD’s market cap has plummeted from an all-time high of $23.5 billion, recorded on November 15, 2022. The current market cap stands at close to $2.1 billion, significantly lower than stablecoins like USDT and USDC, which have market caps of $84 billion and $25 billion, respectively.

The decline in BUSD’s market cap can be partly attributed to regulatory actions taken against its issuer, the US-based company Paxos.

Earlier this year, both the Securities Exchange Commission (SEC) and the New York District of Financial Services (NYDFS) initiated regulatory actions against Paxos.

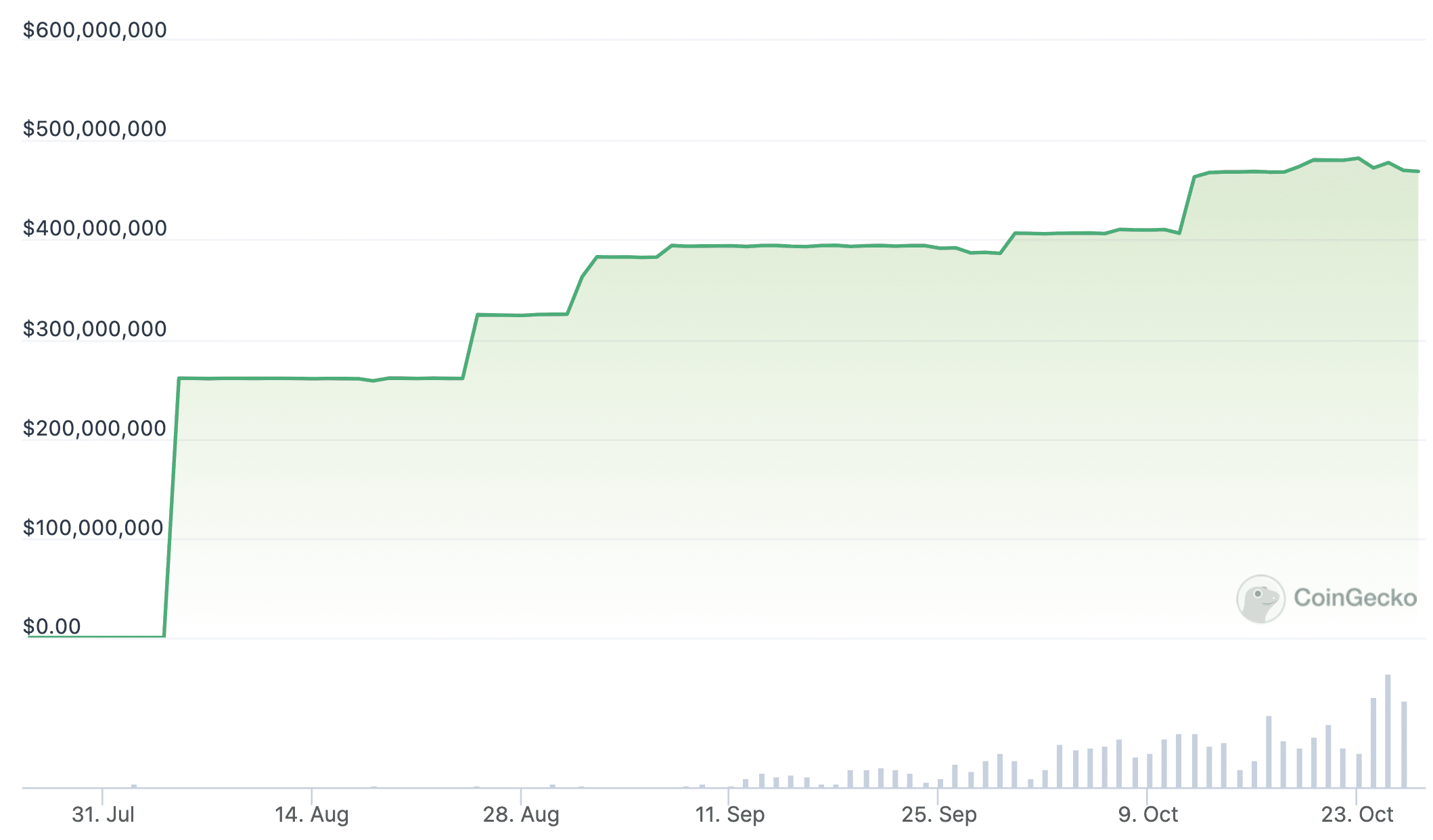

In response to these actions, Binance has indicated that it will move away from using BUSD on its platform, and encouraged users to convert their BUSD balances to FDUSD, a new stablecoin issued by Hong Kong-based First Digital Group.

Likely as a result of this move by Binance, the market share of First Digital USD (FDUSD) is on the rise, now boasting a market cap close to $470 million according to CoinGecko.

Binance users can trade BUSD for FDUSD without incurring any fees, and Binance plans to gradually reduce support for BUSD products by February 2024, as previously reported.

Despite the decline in BUSD’s market cap, the impact on Binance’s overall operations are not likely to be significant given that it is gradually phasing out support for BUSD in line with regulatory pressures.