REPORT | Cryptocurrency-Based Money Laundering Drops Significantly in 2023, Fiat Off-Ramping Is “Important in AML,” As Chainalysis puts it

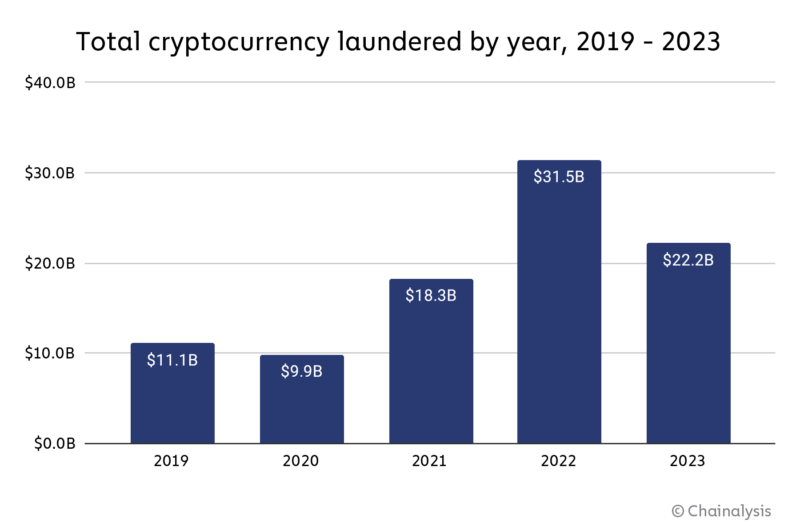

An upcoming analysis by Chainalysis shows that in 2023, illegitimate addresses transmitted $22.2 billion worth of cryptocurrencies to services—a substantial decline from the $31.5 billion sent in 2022.

A portion of this decline could be linked to a general decline in the volume of cryptocurrency transactions, both legal and illegal. In contrast to the 14.9% decline in overall transaction volume, the decline in money laundering activity was more pronounced, at 29.5%, according to the Chainalysis 2024 Crypto Crime Report.

The value of illicit monies that arrived in individual crypto addresses decreased in 2023 as well. A total of $3.4 billion worth of illicit bitcoin was received by 109 exchange deposit addresses, each of which got over $10 million. Even so, there is still a very high concentration. In 2022, just 40 addresses received more than $10 million in illicit cryptocurrency, for a total of less than $2.0 billion.

To better hide their money laundering activity from exchange compliance teams and law enforcement, cryptocurrency fraudsters may be spreading it among more nested services or deposit addresses. To decrease the impact of any one deposit address being frozen for suspicious activity, spreading the action across multiple addresses might also be a tacti

- Chainalysis

According to Chainalysis, the primary destination for money transferred from illegitimate addresses has remained mostly unchanged over the previous five years: centralized exchanges. On the other hand, as illicit funds have shifted onto decentralized finance (DeFi) protocols, the role of illicit services has decreased over time.

“We primarily attribute this to DeFi’s overall growth during that time period, but we also have to acknowledge that DeFi is generally a poor choice for obfuscating the movement of funds due to its inherent transparency,” Chainalysis stated.

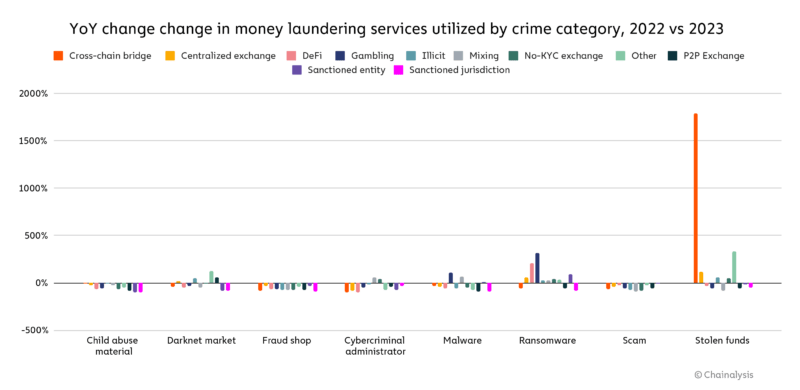

The amount of money transmitted to cross-chain bridges from addresses linked to identity theft increased significantly, as did the amount of money transferred from ransomware wallets to gambling sites and to bridges.

In 2023, illegitimate addresses sent $743.8 million in cryptocurrency to bridge protocols, compared to just $312.2 million in 2022. Hackers with ties to North Korea have been among the most frequent users of bridges for money laundering.

Fiat off-ramping services are crucial because that’s where criminals may turn their cryptocurrency into cash—”the culmination of the money laundering process,” according to Chainalysis, which was recently sued over its techniques for identifying crypto criminality.

The majority of money laundering activities are focused on a small number of fiat off-ramp providers. Just five services received 71.7% of all illicit funds supplied to off-ramping services in 2023, an increase from 68.7% in 2022.