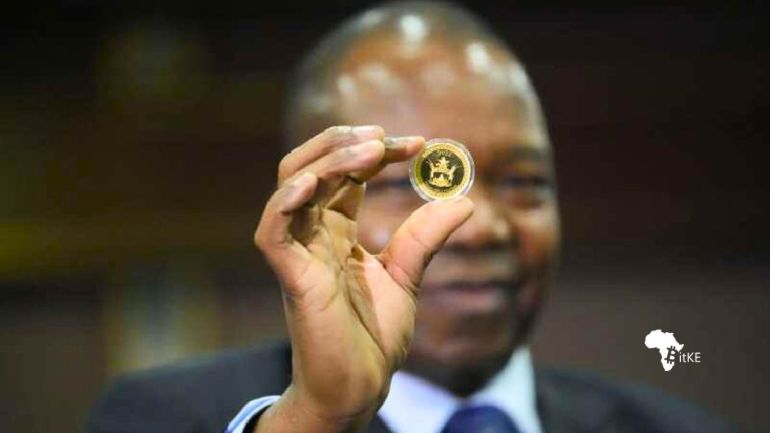

Zimbabwe Introduces the ZiG Gold-Backed Digital Currency

The gold-backed digital tokens, held in either e-gold wallets or e-gold cards, will be tradable and capable of facilitating person-to-person (P2P) and person-to- business (P2B) transactions and settlements. Individuals possessing physical gold coins have the option to exchange or convert them into gold-backed digital tokens through the banking system.

Zimbabwe has finally availed its new digital currency backed by gold for use by individuals for domestic transactions as a counter-measure against re-dollarization.

The digital tokens are subsequent to physical Mosi–ca– Tunya gold coins which were released by the Reserve Bank of Zimbabwe (RBZ) in 2022 and found to be successful in taming the country’s inflation..

The currency, also known as Zimbabwe Gold (ZiG), denominated in milligrams, was introduced with the aim of strengthening the national currency while also providing an alternative investment avenue for the market, diverging from the typical practice of pursuing the U.S. dollar on the unofficial market.

According to a statement by Reserve Bank of Zimbabwe:

“With effect from October 5 2023, ZiG will become one of the means of payment for domestic transactions, over and above its value-preservation purpose. The value of ZiG will be at par with the value of the physical Mosi-ca-Tunya gold coin and will remain informed by the international gold price.

Banks will maintain dedicated ZiG accounts and intermediate transactions in ZiG in the same way thye intermediate transactions in local and foreign currency.”

The gold-backed digital tokens would go live in May 2023 where they were at first issued only for investment purposes, with the bank taking steps to introduce them for use by business and regular citizens. Here, the gold-backed digital tokens, held in either e-gold wallets or e-gold cards, will be tradable and capable of facilitating person-to-person (P2P) and person-to- business (P2B) transactions and settlements, the bank indicated.

The gold-backed digital currency, which opened to the public on October 5 2023, can be purchased from banks using either the local currency or U.S. dollars. Additionally, prices for goods and services will be denominated in ZiGs.

Individuals possessing physical gold coins have the option to exchange or convert them into gold-backed digital tokens through the banking system.

Bank customers will have the capability to conduct transactions through their ZiG accounts using point-of-sale machines or online payment methods.

In August 2023, when he unveiled the mid-term Monetary Policy Statement (MPS), RBZ Governor, John Mangudya, disclosed that the Gold Coins were significant as a key monetary policy tool absorbing more than $35 billion in Zimbabwean dollars from a cumulative count of 36,059 coins as of July 14, 2023

The government, led by President Emmerson Mnangagwa, is concerned that the resurgence of the U.S. dollar in the country’s economy could have detrimental effects on its already fragile economic stability

Zimbabwe’s currency is the worst performing in Africa in 2023, having depreciated by 617% against the U.S. dollar since January 2023. It is however not the only country struggling against the weight of the dollar in 2023 as highlighted below:.

- Zimbabwean Pound => -617% (% depreciation)

- Burundian Franc => -36%

- Egyptian Pound => -25%

- Congolese Franc => -21%

- Sierra Leonean Leone => -19%

- Rwandan Franc => -12.8%

- South African Rand => -11%

- Zambian Kwacha => -11%

This instrument is anticipated to serve as the foundation for the nation’s central bank digital currency (CBDC) given that ZiG, in its present structure and features, shares many traits with a CBDC.